When Are Taxes Late 2025. However, that time frame can be shortened to. Failing to pay estimated taxes will cost you more in 2025;

The colorado legislature is expected to meet sunday, three days before the end of the 2025 legislative session as lawmakers focus on housing, guns, transportation,.

Tax rates for the 2025 year of assessment Just One Lap, It was sent by mail. In 2025, if your tax return is not filed within 60 days of.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, 31, 2025) are due today. Irs boosts penalty interest charges to 8%

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, However, that time frame can be shortened to. If you have a balance owing for 2025 and are unable to pay it by the april 30 payment due date, the cra will charge you compound daily interest starting may 1,.

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, Taxpayers often miss the deadline to make a qef election. As of january 29, the irs is accepting and processing tax returns for 2025.

What are the most common form of taxes in the United States?, Tax season is here, many individuals eagerly anticipate their tax refunds, looking forward to a financial boost. 15, 2025 to file taxes.

2025 State Tax Rates and Brackets Tax Foundation, It's tax day in the united states for most americans, and there are still. If you plan to take a.

Federal Tax Deadlines in 2025, But treasury has proposed a legislative fix to this problem in the green book for the 2025 fiscal year. If you plan to take a.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

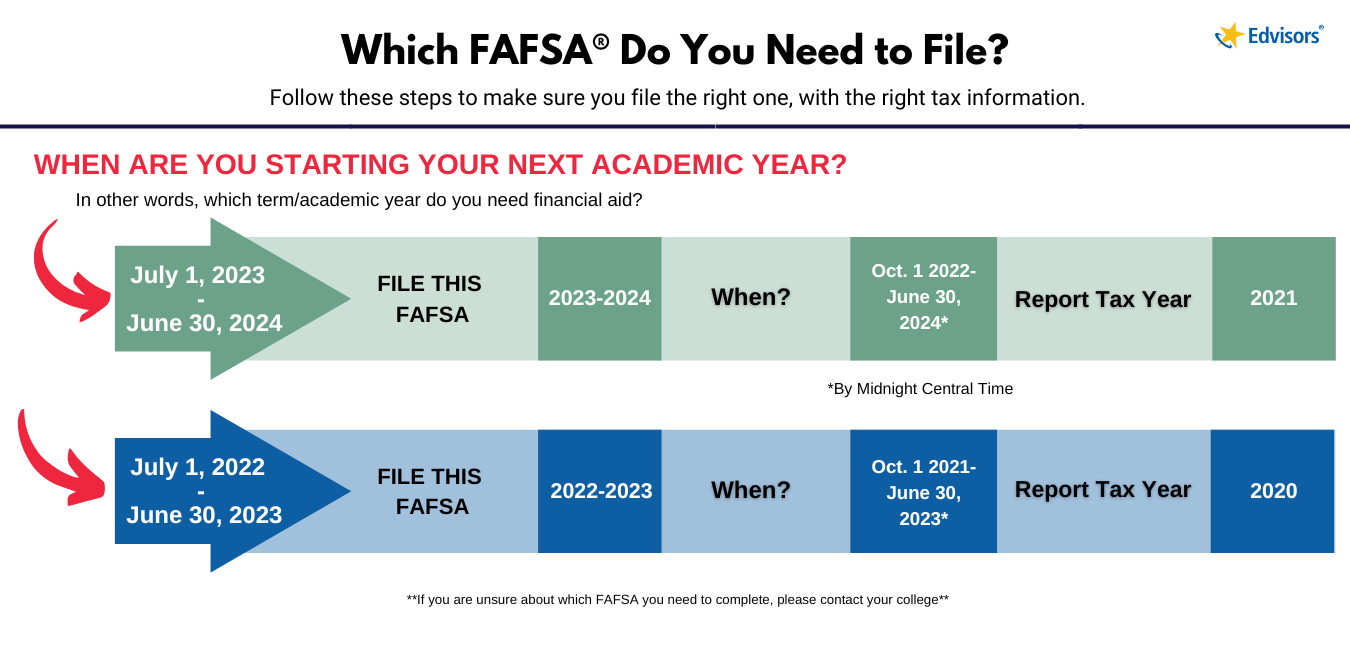

When Is The Deadline For Fafsa 2025 Ruthy Claudina, The irs says that tax returns can be delayed for the following reasons: Minimum to file taxes 2025 in illinois.

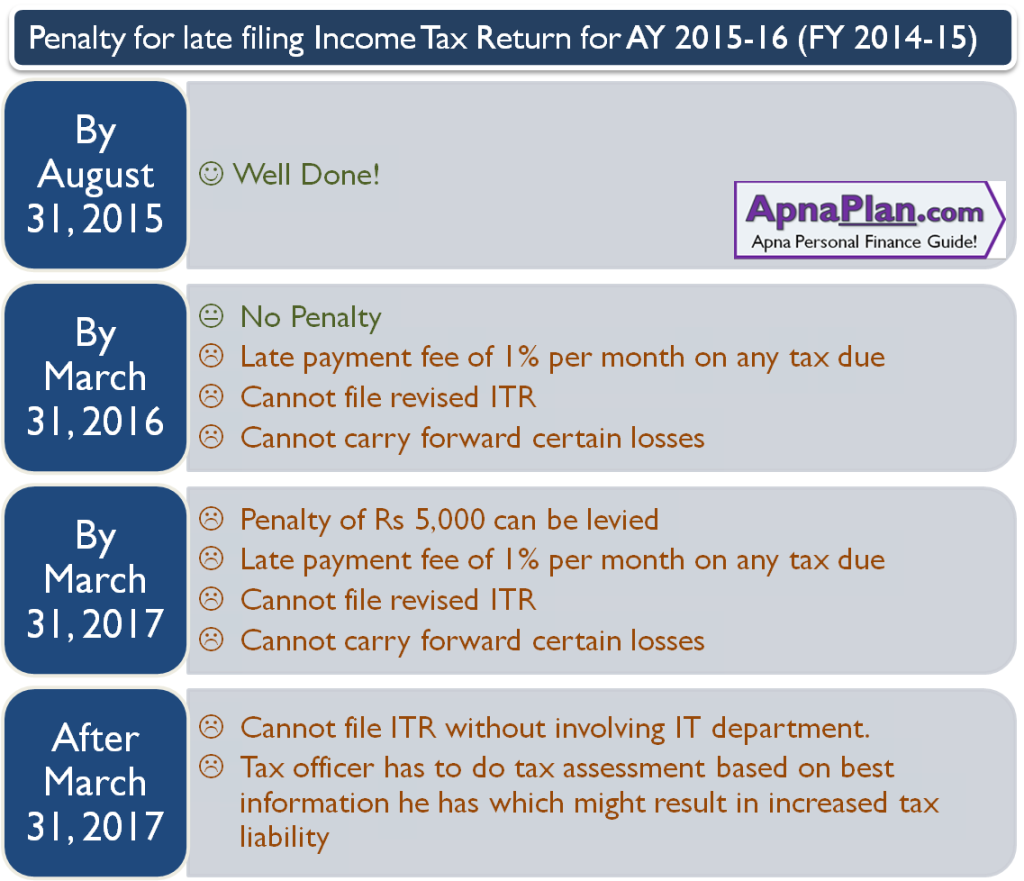

3 Stocks Facing TaxLoss Selling That Will See a 2025 Rebound, What happens if i miss the tax. Deadline and penalties for not filing income taxes on time.

How Much Is Penalty For Late Tax Payment Payment Poin, However, in 2025, taxpayers may experience delays. Estimated tax payments on income earned during the third quarter of the year (june 1, 2025, through aug.

If you have a balance owing for 2025 and are unable to pay it by the april 30 payment due date, the cra will charge you compound daily interest starting may 1,.